ABSTRACT

This study investigates the relationship between corporate social performance (CSP) and corporate financial performance (CFP) within the context of a particular CSP element: environmental investment. Two models of the determinants of companies’ environmental investment are estimated in order to capture the difference between firms’ actual and expected level of environmental investment. The regression residuals are used as our measure of corporate social performance. Both market-based and accounting-based measures of financial performance are applied to represent corporate financial performance.

With the analysis of a sample encompassing 223 Chinese heavy-polluting companies, we have found that it is more likely to observe a significantly positive relationship between firms’ environmental endeavors and their accounting-based financial performance among firms that are more active to disclose corporate information. Besides, building on our empirical findings that corporate social performance is positively correlated with accounting-based financial performance but has no correlation with market-based financial performance, we suggest a priority for managers from Chinese heavy-polluting industries when they fulfill social demands of various stakeholders.

THEORETICAL BACKGROUND AND LITERATURE REVIEW

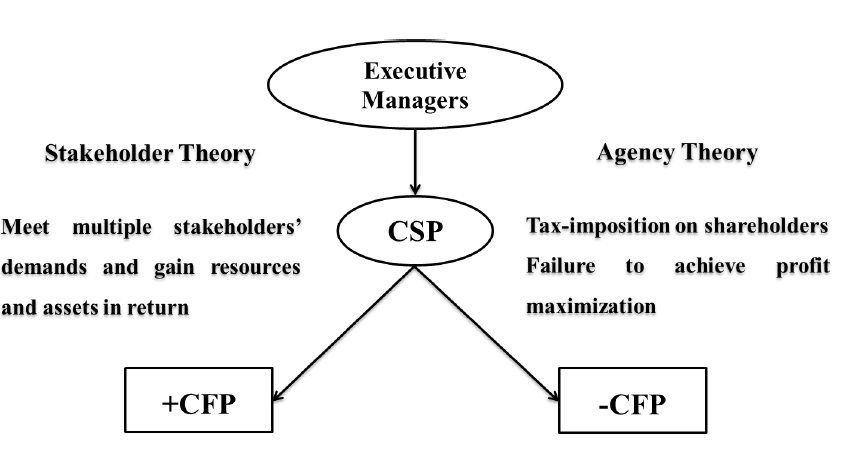

Figure 1.

Friedman (1970) has stated ‘the only justification for the shareholders to hire a manager is to let the manager serve the interests of his/her principal (shareholders or owner).’ While such kind of justification will vanish when the manager imposes taxes and spends the money from shareholders for social purposes. As a result, CSR may harm the shareholders’ economic interests and be detrimental to the companies’ profit maximization. Figure 1 demonstrates the relationship between CSP and CFP based on the stakeholder theory and the agency theory.

METHODOLOGY

In this chapter, we first demonstrate the collection process of our cross-sectional dataset and sample description. Next, we briefly introduce the method we employ in this research to investigate the link of CSP-CFP in general. After that, we detail the measure of CSP and the empirical models from which CSP stems. Subsequently, different CFP measures are presented followed by the illustration of the final stage of our analysis where the correlation between CSP and CFP is examined.

Data and Sample

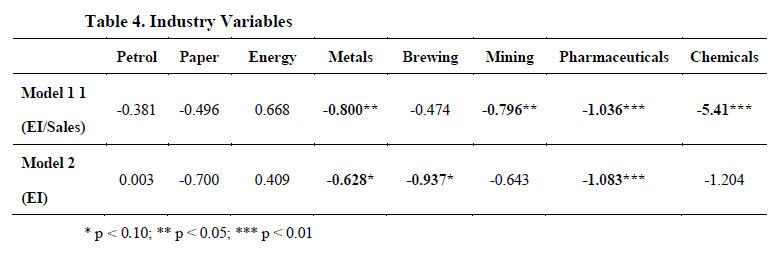

This study aims to investigate the relationship between CSP and CFP of Chinese companies in the context of environmental investment. Therefore, we have primarily focused on Chinese heavy-polluting companies because companies from heavy-polluting industries tend to disclose more environmental information (Kuo et al., 2012) and pay more attention to environmental issues thanks to their significant negative impact on the environment (Aerts & Cormier, 2009). According to Ministry of Environmental Protection of the People’s Republic of China, eight industries including petroleum, paper manufacturing, metals, pharmaceuticals, chemicals, brewing, mining, and energy are defined as heavy-polluting industries in China.

RESULTS

Determinants of Environmental Investment

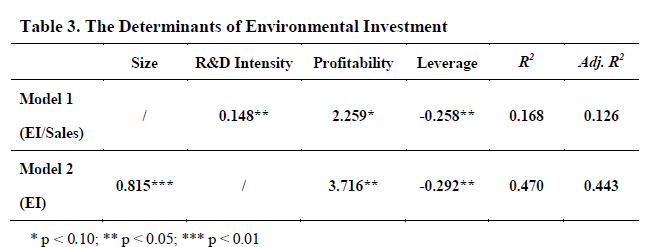

Table 3 and 4 report the results of estimating two linear regression models of the determinants of environmental investment. In particular, we can see from Table 3 that as anticipated, both estimations indicate that financial resource availability significantly affects environmental investment. Firms with higher profitability (p = 0.092 in model 1 and p = 0.011 in model 2) and lower leverage (p = 0.026 in model 1 and p = 0.028 in model 2) invest more in environmental CSR activities in terms of both the rate and the amount of environmental investment.

DISCUSSION

In quest of the underexplored research topic of the relationship between corporate social performance and financial performance of Chinese companies, we have employed a different CSP measure inspired by a statistic method that Fama (1981) has used to evaluate the unexpected stock returns in his research. Our empirical findings suggest that among Chinese heavy-polluting companies that have already disclosed their 2014 annual financial information, firms with better social performance in the sense that they invest more in environmental activities than what would be expected have a significantly higher accounting-based financial performance.

CONCLUSION

This study aims to shed new light on the relationship between corporate social and financial performance of Chinese firms within the context of a specific CSP component: environmental investment, with an eye towards useful managerial recommendations for managers from Chinese heavy-polluting companies when they decide whether to invest in environmental CSR activities.

Based on a specially constructed cross-sectional dataset of Chinese heavy-polluting companies, we adopt two empirical models of the determinants of environmental investment using different operationalizations of environmental investment. The regression residuals of the models are then regarded as the indicators of CSP. Our findings are aligned with many current research results and support a positive relationship between CSP and accounting-based CFP. However, this positive relationship only appears among those firms that have already disclosed their 2014 annual financial data.

Importantly, our research differs from extant studies in two major aspects. Firstly, our methodology of measuring CSP concerns the significance of deviation from expected level of CSR efforts for a company’s financial performance. The other distinction lies in our effort to investigate the CSP-CFP link within the context of environmental CSR dimension, which deserves deeper research but lacks investigation to date.

Source: Uppsala University

Authors: Lijun jiang | Qishen Yang