ABSTRACT

In the last decade, there has been a great increase in the number of mergers and acquisitions all over the world. This enhancement of the number of transactions is included in the most of the previous studies but moreover, many of these studies show that the majority of the mergers and acquisitions fail in the objective of creating value for the shareholders. This failure ratio is the reason which leads us to the next research.

Question: why do the majority of mergers and acquisitions fail?

In this study, we introduce the basic concepts that must be known before answering the research question and the reasons that other authors have pointed out for explaining this failure ratio.

After this theoretical background, we conduct a comparative research of four cases, some of them with a successful result and some others with a failure one, in order to determine the key factors that explain the reasons why some of the mergers and acquisitions fail or success.

The study shows that there is a wide range of features when determining this failure or success. The analysis of the four case studies indicates that most of the reasons for this failure or success were previously considered by other authors, but some new reasons will be presented.

THEORY REVIEW

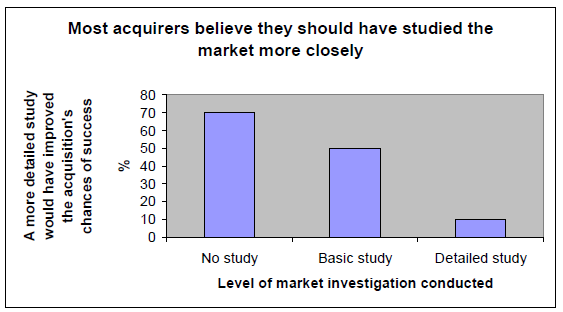

Lack of knowledge of industry or target firm. This knowledge includes issues like examination of manufacturing facilities, product design facilities, rejections rate, marketing net works, profile of key people and productivity of the employees. The acquirer company needs to know how the target company works, its competitive advantages and the critical success factors for achieving revenues. The next graphic shows the belief of most of the acquirers that they should have studied the market more closely.

Fig 2.1 Most of acquirers believe that should have studied the market more closely.

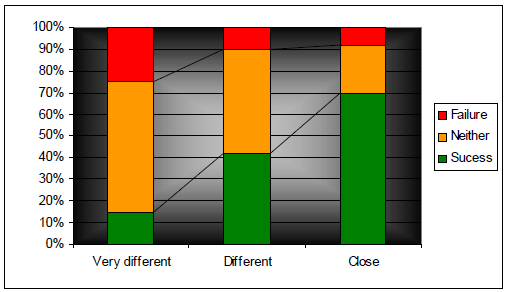

Clarity of acquisition purpose. According to the study of Coopers and Lybrand, this is the second most answered reason for success. If the objectives of the transaction are clear, employees will be able to adjust themselves faster to the new objectives and in a better way. Good cultural fit. This is the third reason, according to the study of Coopers and Lybrand. The next figure is very illustrative to represent the chances of success depending on the cultural gap. The lower the cultural differences are, the bigger the chances of success.

Fig. 2.2 Chances of success depending on the cultural gap.

Throughout this analysis of profitability we will get some answers but we will try to summarize this issue as much as possible to make this study easier to read. The next figure provides a good model of how some changes in operational and financing activities becomes in changes of ROCE or shareholders profitability. According to the figure, the value is generated by economics factors. It is important to know the business to understand which factors will determine value creation. We will explain this by breaking down the return on common equity.

The next model represents a summary of the theory in order to present it in a more clear way.

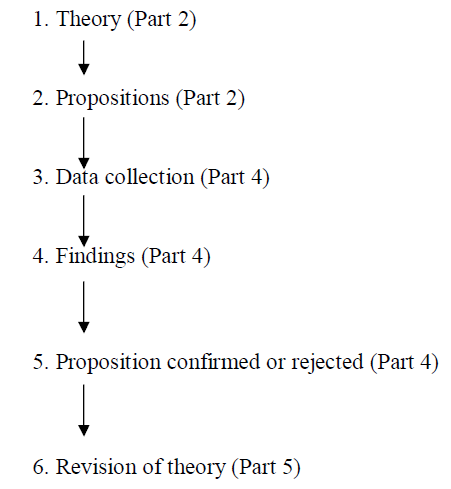

SCIENTIFIC APPROACH AND RESEARCH DESIGN

We will follow a deductive way of conducting our study. It means that we will study the existing theory (explained in the second part) to create our own propositions extracted from the theory that will be discussed through the empirical study. The process that we are developing will be explained in the next figure.

2.6 Fig. Deductive model.

CASE STUDIES: STORA ENSO, QUAKER SNAPPLES, BP AMOCO AND TELIA SONERA

Stora Enso

The forestry industry is formed by a group of relatively mature large-scale lines of business that are becoming more global during the last 20 centuries. The forest industry has been one of the fastest growing businesses. While in the beginning of the 20th century, less than ten million tons of paper were produced, in 1950, 43 million tons were produced, growing to 260 million tons in 1995, which represents an annual four per cent growth in the last century. The fastest growth has occurred during the period 1990-2003, which sales represent the 61 per cent of the sales in the post-war era.

Although North American companies have leaded the market historically, Nordic companies have caught up the distance. Almost one-third of the world production comes from Nordic companies. The reasons for this increase are: large investments in new production and technologies, a process of consolidation, the increase in the importance of forestry clusters in the national economies of the Nordic countries, and the faster growth of the demand in Europe.

REVISION OF THE THEORY

Cross-case Study of the Former Propositions

Proposition 1: For all those cases which we have found information, the findings support the previous theory. We can conclude that less cultural differences between two companies lead to a more successful implementation process.

Proposition 2: All the information found support the previous theory. No post acquisition planning is negatively associated with negatively managed implementation process.

Proposition 3: We have found information related to this proposition in all the cases, and all the findings support the previous theory. We conclude that a lack of knowledge of the industry or the target firm is negatively associated to a successful implementation of the merger or acquisition.

Proposition 4: In three of the four cases we have studied, the findings are related with the previous theory, but in the case of Quaker Snapple the findings do not correspond with. As we said during the third part of our thesis, this does not mean that the theory is wrong, due to the fact that these findings are difficult to generalize. However, we think that these findings should be taken into account because they can be of great interest for other companies.

CONCLUSION

We want to quote for the last time our research question, which we have been trying to answer throughout all this study.

Why do the majority of merger and acquisitions fail?

Even though the majority of mergers and acquisitions fail, in the last years the number of mergers and acquisitions has increased extraordinarily. After our research, we have found that the main reason why companies merge or acquire other firms is the changes in the industry where they are playing in. For example, the acquisition of Amoco by Bp and the Stora and Enso’s merger took place in order to solve the problems of the maturity of their respective industries. In the other hand, the merger between Telia and Sonera occurred in order to become a bigger player in an industry where being global is going to be a matter of survival.

There are many reasons for the failure of an acquisition. Throughout the theoretical background part we have presented the main reasons for this failure. We also have checked if those reasons were relevant for each one of these cases by following a comparative design between different case studies.

We have added new findings to the results. This issue is important for us since we have developed this study with the main idea of finding new propositions which can be interesting and useful for other students or firms. We can finish by saying that we are satisfied with our research because we have reached our goals of contributing to develop the archival theory and we believe that we have covered a good part of the issues that involve mergers and acquisition. Further studies can be used to support this one but, at least, we see the theoretical part as a good briefing to order all the ideas around this topic.

Source: Umea University

Authors: Aitor Iturralde Collantes | Manuel Nacha Jiménez