ABSTRACT

Purpose of this study is to investigate market anomaly and possible arbitrage opportunity around ex-dividend day. We investigate most liquid common stock prices behavior around the world. Our sample data covers NYSE (Companies from S&P 100 index), London Stock Exchange (Companies from FTSE 100 index), Shanghai Stock Exchange (Companies from SSE180 index) and Tokyo Stock Exchange (Companies from TOPIX 100 index). We also investigate possible arbitrage opportunity based on abnormal return and short-term trading activities around ex-day.

Based on raw price drop ratio, market adjusted price ratio, raw price drop ratio, market adjusted price drop ratio, market adjusted abnormal return and relative trading volume we developed six null-hypotheses and conclude this study. We used t-test to determine the mean differences between theoretical values and observed values and for median differences we used Wilcoxon Sign Rank Test.

This study observed an equal drop of stock prices compared to dividend amount from New York and Shanghai Stock Exchange. We found no evidence of short-term trading activities around ex-date from both markets. In Tokyo Stock Exchange stock prices fall less than the dividend amount and individual dividend amount has higher taxation compare to capital gain.

It provides strong evidence in favor of tax effect and we also recorded significant evidence of short-term trading activities before ex-dividend day. However, we documented mixed evidence from London Stock exchange. In London Stock Exchange Stock Prices drop more than dividend amount and dividend has higher taxation than capital gain. This evidence is not consistent with tax hypothesis but we found strong evidence of short-term trading before ex-dividend day.

THEORETICAL FRAMEWORK / LITERATURE REVIEW

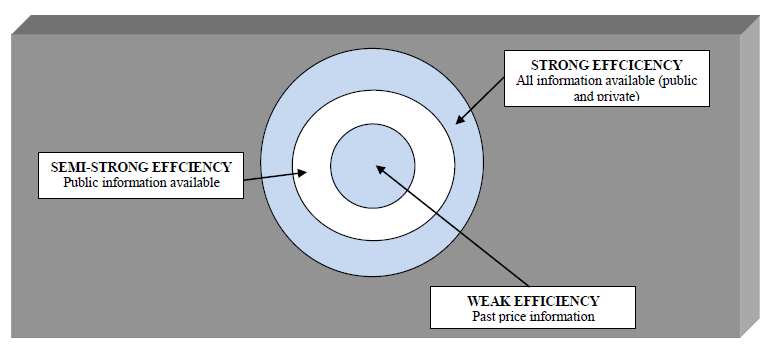

Figure 1: Types of Market Efficiency.

Fama (1970) explained different models to test the efficient market theory. Roberts (1959) was the first to test the weak and strong forms of efficiency. Fama (1970) tested the weak form, the semi-strong form and the strong form of market efficiency to conclude that the efficient market models were hold.

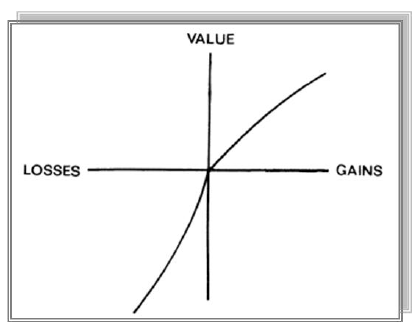

Figure 2: A Hypothetical Value Function.

Kanheman & Tversky (1979) have defined a value function of the decision people make. We suppose this phenomenon of the arbitrage happens on the ex-dividend day when market anomalies are created. At this time, we observe the short-term trading.

METHODOLOGICAL FRAMEWORK

This chapter shall explain the methodological frame work of our study which consists of several parts; choice of subject, perspective, preconceptions, underlying philosophy, scientific approach and research method.

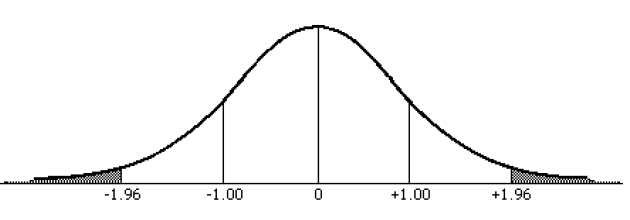

Figure 4: Normal distribution curve at 95% confidence level.

To find the differences of observed mean (of RPR, MAPR, RPD and MAPD) value from its corresponding theoretical mean value, we used t-test. Wilcoxon Signed Rank Test has been used to find the differences of observed median value form its theoretical value. T-test also used to determine the significance of MAAR and RTV. T-test: The theory of significance in statistic is based on assumptions. Theory explains that the event that has chance to occur 5% is statistically significant. In normal distribution the score stands outside of -1.96 and +1.96 (See figure 4).

EMPIRICAL FINDINGS AND ANALYSIS

The below table represents the theoretical (hypothesized value) mean and median value of Raw Price Ratio (RPR), Market Adjusted Price Ratio (MAPR), Raw price Drop ratio (RPD), Market Adjusted Price Drop ratio (MAPD), Market Adjusted Abnormal Return (MAAR) and Relative Trading Volume (RTV) (before and after ex-day) of New York Stock Exchange, Tokyo Stock Exchange, Shanghai Stock Exchange and London Stock Exchange.

To document the market anomaly and arbitrage opportunity we used t-test for mean differences and Wilcoxon Rank Test for median differences at 95% confidence level. T-statistic also used to find the evidence of arbitrage opportunity (MAAR represent inefficiency and thus arbitrage opportunity) and short-term trading around ex-date.

CONCLUSION

The purpose of this study is to examine the market anomaly and possible arbitrage opportunity from New York Stock Exchange, Tokyo Stock Exchange, Shanghai Stock Exchange and London Stock Exchange. Among all stock markets, in general these stock markets are considered as most efficient stock markets. We have studied most liquid common stocks which are included in S&P 100 index (listed in both NYSE and NASDAQ Stock Exchange), FTSE 100 (London Stock Exchange), SSE 180 (Shanghai Stock Exchange) and TOPIX 100 (Tokyo Stock Exchange). We chose these stock markets because each of the stock market is situated in different geographic locations where behavior of investors, institutional trading rules and tax code are different.

We concluded our study based on six null-hypotheses which are developed from raw price ratio, market adjusted price ratio, raw price drop ratio, market adjusted price drop ratio, market adjusted abnormal return and relative trading volume. To find the mean differences from theoretical values we used t-test and for median differences we used Wilcoxon Sign Rank Test. In the following table we present our hypothesis and evidence of acceptance of hypotheses from different markets.

We have recorded mixed evidence from different markets. From London and Tokyo Stock Exchange we have documented strong evidence in favor of market anomaly and possible arbitrage opportunity. In contrast, in both market, stock price movements are different from each other on ex-date. In Tokyo Stock Exchange stock prices fall less than the dividend amount which is consistent with tax hypothesis (meaning higher taxation on dividend income than capital gain).

Stock prices drop more than the dividend amount in London Stock Exchange which is consistent with prior studies on UK market done by M. A. Lasfer (1995) and M. Lasfer (2008) but not consistent with the tax hypothesis. From both markets, we recorded strong evidence of short-term trading before ex-dividend day. In case of Tokyo Stock Exchange this result is not consistent with prior study on Japanese market by Kato & Lowenstein (1995). Higher volatility of stock price movement around ex-day and too high stock price fall than dividend amount in London Stock Exchange suggests for further study to investigate the causes behind such volatility.

Source: Umeå School of Business

Authors: Islam Md Mohibul | Jessie Cadilhac