ABSTRACT

The concept of grandstanding comes from Gompers (1996), in his article, he defined “to grandstand” as “to act or conduct oneself with a view to impressing onlookers”. The idea of grandstanding does not only apply solely to venture capital but also could apply to underwriters of IPOs industry as well.

IPOs activities provide huge revenues for underwriters, so underwriters compete with each other for IPO business. China’s stock market grows explosively after 2006, and it has the highest under pricing, as well as more and more underwriters have emerged recently, so our paper is constrained under Chinese stock market environment. We empirically examine whether inexperienced underwriters grandstand when they conduct IPOs in order to achieve more market shares, for example by deliberate under pricing or charging lower fee rates.

This study is conducted from the underwriter’s perspective. We use two kinds of reputation measurement methods to define “inexperienced” and “prestigious underwriters” and employ a quantitative approach to analyze the data. Evidence from a sample of 392 IPOs from June 19, 2006 to March 24, 2010 suggests that inexperienced underwriters do not have incentives to grandstand. The number of IPOs that underwriters have conducted and recent IPO performance do not always contribute to a gain of market share directly. Therefore, inexperienced underwriters do not provide more under priced IPOs nor do they charge lower fee rates. Evidence also marginally supports that underwriters do not intend to conduct small offer sized IPOs.

THEORETICAL FRAMEWORK AND LITERATURE REVIEW

Figure 2.1 The IPO process.

Finally if the IPO ends by successfully raise the money for issuing companies, issuing companies will pay the commission fee for the services received (the fee varies with the choice of offer mechanism). Now we have briefly described the whole IPO process (Figure 2.1) and the three main participants (issuer, underwriter and investor) here. We will explain and discuss the role and function of each participant in detailed in the following section.

METHODOLOGY

Choice of Subject and Preconceptions

Both of the two authors have studied several financial courses in Umeå School of Business. Without study into this area, we cannot pick this topic and conduct this study. In financial market and corporate finance course, we heard that China have the highest level of underpricing in initial public offering all around world. So it inspires us and we hope to figure out whether it is the truth and why this phenomenon exists.

It is the initial idea for our choice of subject. Since the Chinese stock market is an emerging market and regulation is not as mature in the US or European market, we have the opportunity to explore some interesting results. Meanwhile, we are both very interested in the stock market. Especially one of the authors has been an active investor in Chinese stock market for several years. Moreover, he also has the experience of bidding initial public offering.

He has a feeling that sometimes the IPOs have huge underpricing, but sometimes the first day initial return even is negative. Because he does not pay attention on the IPOs’ underwriter, so in this research he will go to examine the impact of underwriters on underpricing. For all the reason above, we decide to study the subject of underpricing phenomenon in initial public offering and find deeper related factor around these.

EMPIRICAL STUDY

Research Design

In this section we will explain the methods that were applied in the analysis and how this research design helps us to derive answers regarding our research questions. To find out the potential benefits of IPO for underwriter, and what kinds of action underwriters take in order to reap those benefits. Three types of analysis were used to prove the results both descriptively and statistically.

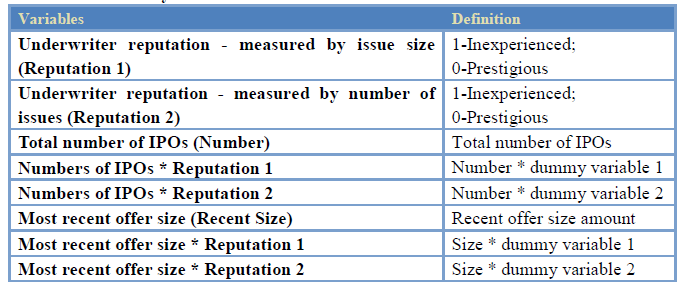

Table 4.1 Summary of variable measurement.

We have used the latest IPOs offer size as a proxy for this variable. Specifically, we choose two types of market share to examine the relationship. First, the market share of the whole sample period helps us to observe the whole picture of market. Second, the latest market share of year 2009 helps us to capture the recent movements of market. This two dimensional analysis help us to avoid bias and increases the accuracy and creditability of the results. The following variables are defined and all the variables are summarized in the table.

EMPIRICAL RESULTS AND ANALYSIS

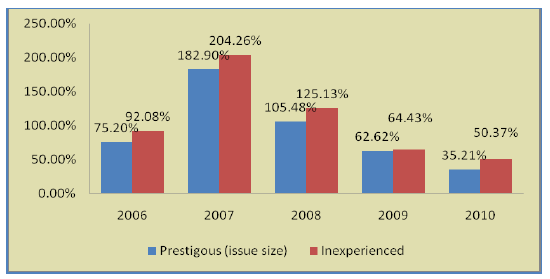

Figure 5.3 Summary of underpricing in different year (1).

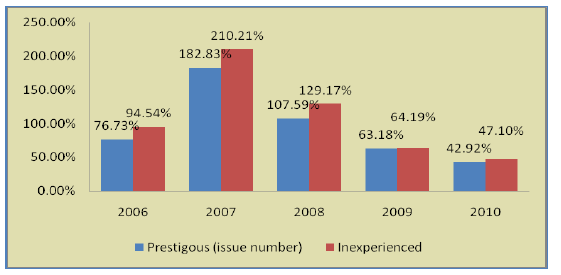

Figure 5.4 Summary of underpricing in different year (2).

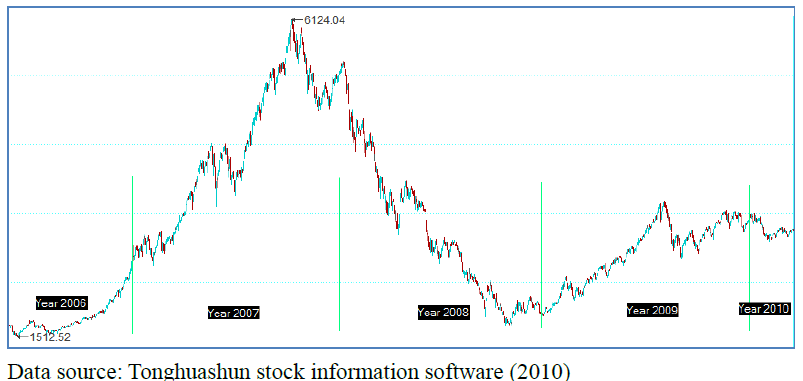

Figure 5.5 Shanghai stock exchange composition index from year 2006 to 2010.

Second, after we summarize the data within different years, we observe from Figure 5.3 and 5.4 that the underpricing level peaks in 2007 and declines in the following years. From Figure 5.5, we found the market index also peaks in year 2007 and had a huge drop after that and rebounded in year 2009 and 2010. In our study we use Shanghai Composition Index (SCI) as our market index (see Figure 5.5) because SCI is the most influential market index in China (Tatro, 2010; Bloomberg, 2010).

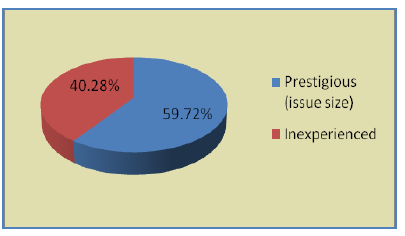

Figure 5.8 Market share in year 2009 (first reputation measurement method).

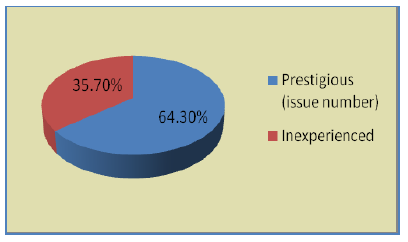

Figure 5.9 Market share in year 2009 (second reputation measurement method).

We demonstrate that the latest market shares segmentation changes about 10% in Figure 5.8 and 5.9. In year 2009, the prestigious underwriters only take up around 60% of the market share. In addition, the two figures also show a slight difference in market share with different measurement (59.72% versus 64.3% in prestigious group).

CONCLUSIONS

In our study, the grandstanding hypothesis provides us a great opportunity to apply an existing theory to a new area. We have taken advantage of the explosive stock market growth in an emerging country where lots of new market players have emerged. This has provided us with a balanced and appropriate mixed data set which made our test of grandstanding hypothesis possible. Also we examined the underwriters’ performance with their IPOs and find that the average underpricing in China is still at a high level (114.2%, even if we use the recent market data from 2006 to 2010).

The latest market share (year 2009) of prestigious underwriter and inexperienced underwriters has changed, when compared with the market share segmentation in the whole study period (June 19, year 2006 to March 31, year 2010). Inexperienced underwriters’ market share has increased although the grandstanding hypothesis is not supported.

In the descriptive statistics section, there are significant differences in offer size, fees or rates charged issuers when comparing the prestigious underwriters group with the inexperienced underwriters group. But when we add other factors into the regression model to examine this phenomenon, we obtained insignificant results on fees or rates and marginally significant results on offer size. This means that the different choices of underwriters do not have significant impact on either variable. Inexperienced underwriters do not deliberately offer higher under pricing for IPOs nor do they charge lower fee rates or choose to conduct smaller offerings. The grandstanding hypothesis was not supported based on our empirical study.

Source: Umea University

Authors: Jian Jiao | Xuan Guo